- +91 22 3512 8738

- info@innvoceptsolutions.com

- Solus, 1002 & 1913, Thane, India 400607

Trends in store for the clinical and contract research organizations post-pandemic

Innvocept

August 14, 2022

Trends in store for the clinical and contract research organizations post-pandemic

Contract research organization (CRO) business in the pre-COVID-19 era (1,2)

The last five years have seen contract research organization sectors blossom in terms of value along with merger and acquisition (M&A) transactions. The increased use of pharmaceuticals, cost reduction of supply chains to regional and national manufacturing hubs, and novel innovative medicines driving strong investor interest in these business sectors, are the main drivers for this enhancement.

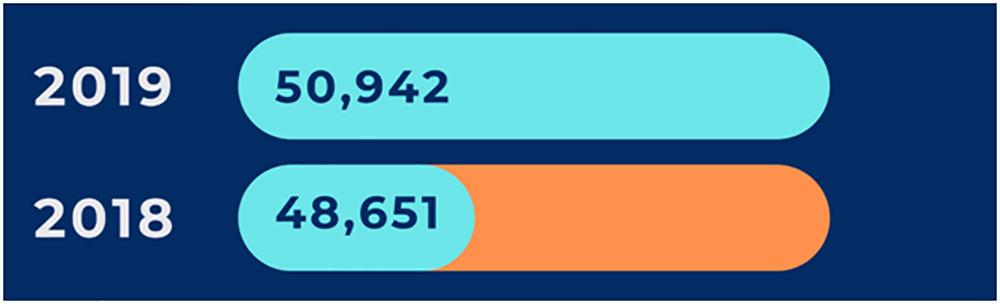

There has been a significant increase in the number of clinical trials during 2019 as compared to 2018:

The COVID-19 pandemic came with extraordinary global health and humanitarian challenges. Along with deep dislocation across the global economy, it has also caused huge economic disruption for governing bodies, companies, and individuals. In this situation, companies not only had to deliver benefits to society & environment but must meet the bottom line of their business.

Pharma companies came out in front and center by supplying vital medical products and services to support patients in their time of need. These pharma companies along with the help of CROs attracted widespread attention to developing new therapeutics and vaccines for COVID‑19 which could bring back everything to normal. However, at the same time, healthcare professionals, found it difficult to adjust and work in a remote environment. Clinical trials were severely affected by disarrangement in both new enrolment and challenges to maintaining existing patients on therapies.

COVID-19 impact on ongoing research (5)

Before COVID 19 there was rapid, dramatic, and long-term progress in the field of research. But the pandemic had either retrenched most academic, industry, and government-based science and clinical research or redirected research to COVID-19.

Except for a few life-saving therapies, most clinical trials have been either stopped or paused, while other ongoing trials are now closed for new enrolment.

To reduce the risk of COVID-19 infections to the study participants, the ongoing clinical trials were modified, enabling home administration of treatment and virtual monitoring.

Apart from minimizing COVID-19 infection, these processes also avoid diverting healthcare resources from the pandemic response.

The situation has become more critical to protect research in progress, as well as physician-scientist focus on the research workforce.

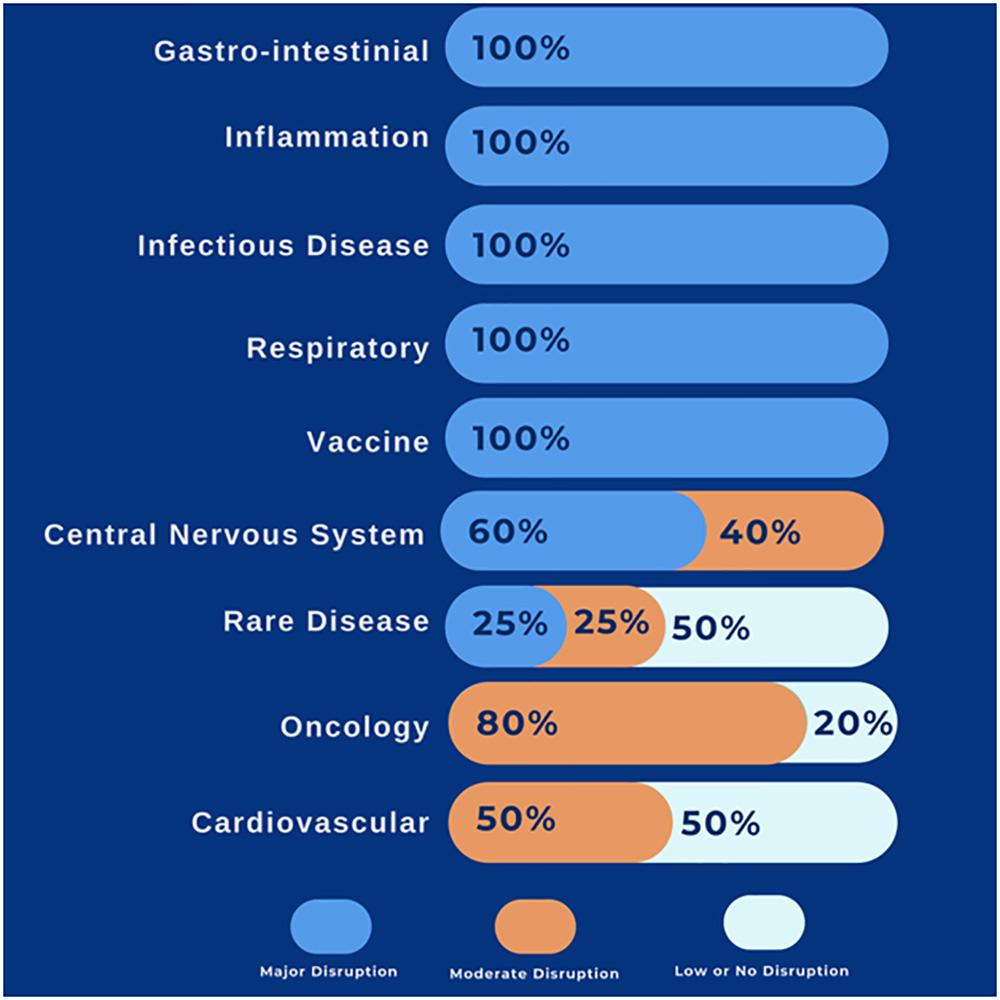

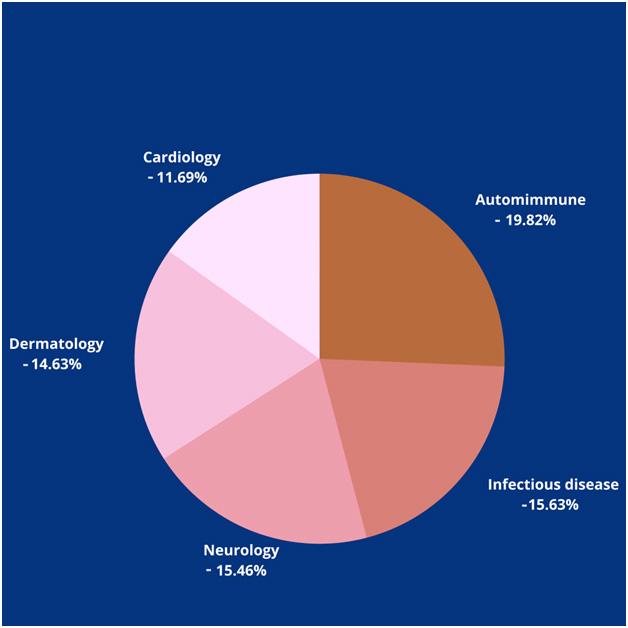

Reported disruption level of clinical trials, therapeutic areas wise, (%) of the respondent (2,4):

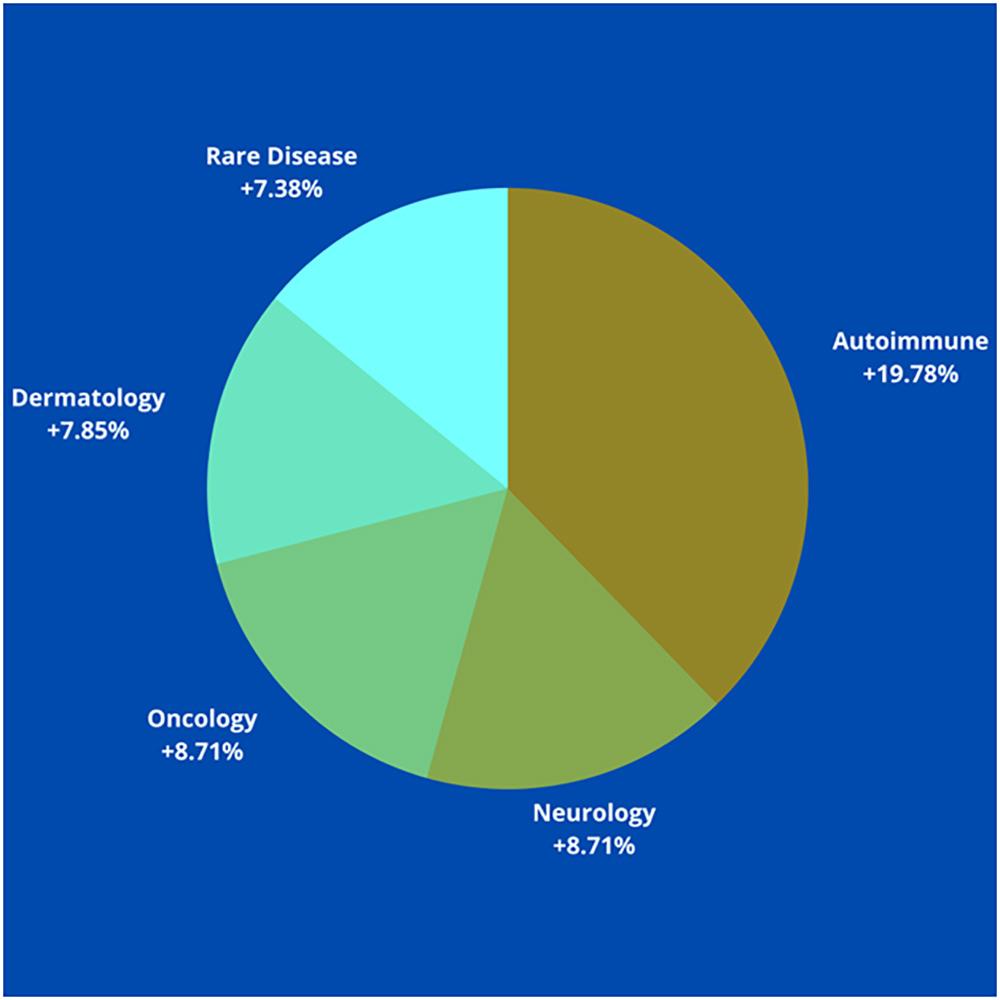

These are the top five therapeutic areas that are negatively impacted during the pandemic. There is a sheer drop in the number of trials during 2020 compared to 2019:

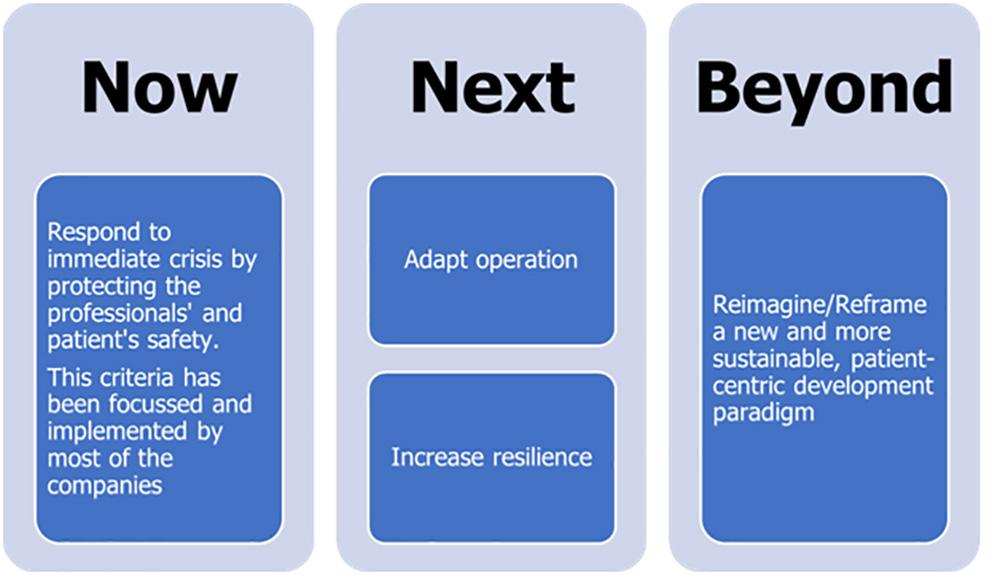

Plan of action (3,4)

Possible trends for CROs in the future (6,7)

1. Developing a recovery plan

The pandemic has caused a huge number of fluctuations in clinical trial operations (such as missed patient visits and lowered new enrolment), raising concerns about the trial and data integrity. As most pharma companies and CROs are considering resuming the paused trials and starting new ones, it is important to analyze and prioritize which trials to reopen by weighing factors such as,- degree of unmet medical need

- which compounds contribute to the company’s future R&D productivity, and

- healthcare system resources that trials would take up at clinical sites.

2. Embracing the ‘Digital Bridge’

- Digitalization was a ‘can’ before the pandemic. It’s now a ‘must’.

- Sponsors and CROs are continuously trying to fasten the clinical trials and improve the experience for patients and physicians through trial decentralization.

- Acceptance of decentralized clinical trials with advancements in trial activities conducted remotely and in participants’ homes, has significantly increased during this pandemic.

- Virtualization in both consumer and trial contexts has also been accelerated at present.

- Digital methods and tools like electronic consent, telehealth care, online doctor consultation, remote patient engagement (virtually assessing end-points wherever possible), in-home nurse visits, shipping investigational medicinal products directly to patients, and electronic clinical-outcome assessments (eCOAs), are implemented, which allows investigators to maintain links to trial participants without in-person visits.

- Mobile and home healthcare, as well as alternative-care locations, are making it possible to conduct trials away from research sites.

- While most clinical trials may not support complete virtual models, the use of one or more decentralization elements or hybrid models (traditional and digitalization) based on suitability for their endpoints, patient populations, and treatments can be considered.

- Traditional site visits will still be needed for complex procedures and specialized assessments.

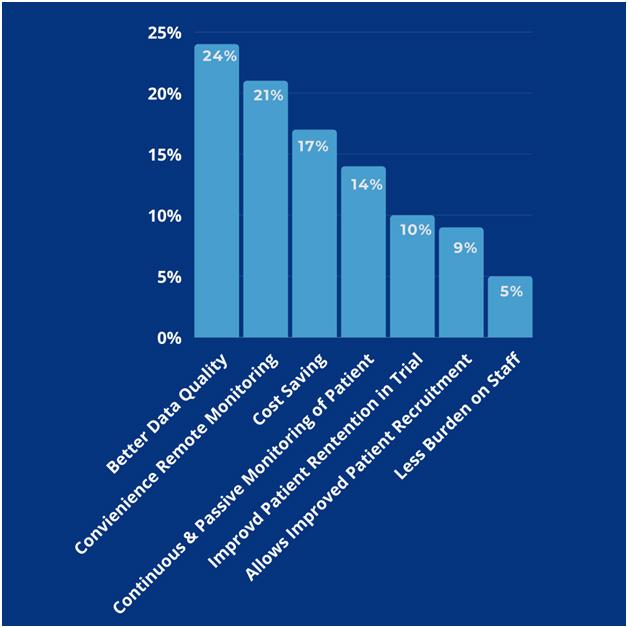

Possible benefits of virtual clinical trials (8-11)

Participants’ benefits

- Through digitally available study websites and consent portals, the participants became more aware, informed, and thoroughly educated about their condition.

- This encourages them to participate in patient engagement methods, provides a quick solution to their queries/concerns, and prompts virtual visits whenever required.

- The chances for missing data are minimized, due to close monitoring through an electronic platform.

- Patient-centric approach by learning more about the participant’s lifestyle with this transparent real-time data sharing, collaboration, and communication, can be implemented, which will be beneficial for both CROs and participants.

Cost-effectiveness

- In the long term, the CRO economics may not change, but travel will be reduced, and the technology investment will grow and thus it will accelerate the process.

- Elimination of the cost of missed/unnecessary appointments, and much more, are possible due to virtual visits.

The business expectation in this current year and beyond (3,12-17)

To enable more and more virtual and remote clinical trials, the leading pharma, CRO, and eClinical software providers must collaborate to share risk, co-develop, and cooperate for both resilience and response.

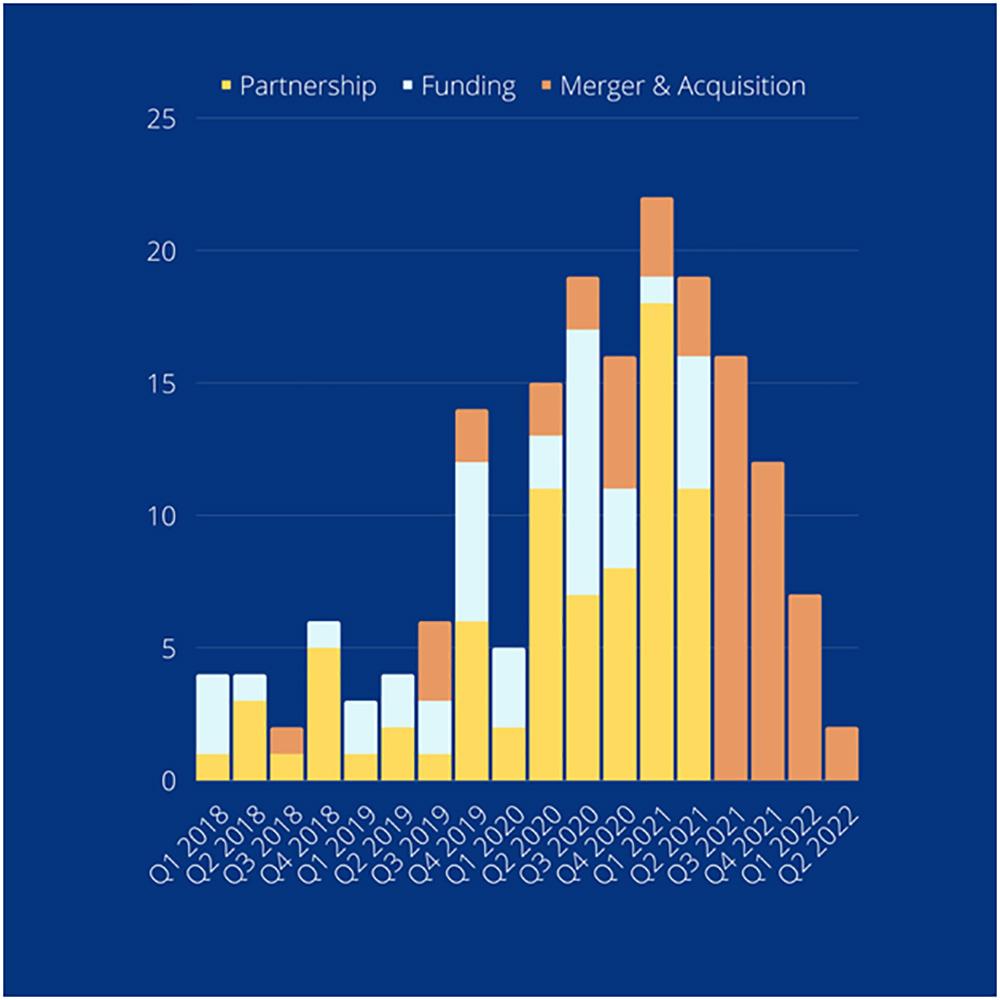

Several specialized virtual trial providers have also attracted considerable attention during the pandemic, which resulted in a rise in all deal-making activity over the past two years.

The number of deals in the virtual trials space from 2018 till 2022 (Q2):

During the clinical development process, collaboration with a CRO is an essential and significant step for biotech and pharma companies as well as for nutraceuticals and cosmetic industries.

Approximately, 44% of the market share is occupied by small and mid-sized CROs for clinical trials.

It has been observed there is a clear need for science-driven CROs in present times. Gaining access to giant CROs for smaller/start-up pharma, biotechnology, and academic institutions may be extremely challenging. Thus, the demand for small and mid-sized CRO services is growing, who can bring real-world experience to each trial and further become a scientific driving force and powerhouse behind the project’s study design, execution, and ultimate success.

References

- Kevin Bottomley. CDMO & CRO Outlook in 2022 and Beyond, Partner, Results Healthcare 10 May 2021. Available at https://www.contractpharma.com/issues/2021-10-01/view_features/cdmo-cro-outlook-in-2022-and-beyond/. Accessed on 8th December 2021.

- Recovering from Covid: The 2021 Clinical Research Market. An overview of trends in the industry covering 2018, 2019, 2020, and 2021. TrialHub. Blog. Available at https://trialhub.findmecure.com/blog/whitepapers/recovering-from-covid-the-2021-clinical-research-market/. Accessed on 8th December 2021

- Falco Weidemeyer. COVID-19: Which critical choices should businesses make next? Available at https://www.ey.com/en_in/long-term-value/covid-19-critical-choices-businesses-should-make. Accessed on 8th December 2021.

- Agarwal G, Parry B, Suresh B, et al. COVID-19 implications for life sciences R&D: Recovery and the next normal. McKinsey & Company. 13 May 2020. Available at https://www.ey.com/en_in/long-term-value/covid-19-critical-choices-businesses-should-make. Accessed on 8th December 2021.

- Weiner, D.L., Balasubramaniam, V., Shah, S.I. et al. COVID-19 impact on research, lessons learned from COVID-19 research, implications for pediatric research. Pediatr Res 88, 148–150 (2020).

- Agarwal G, Moss R, Raschke R, et al. No place like home? Stepping up the decentralization of clinical trials. McKinsey & Company. 10 June 2021. Available at https://www.mckinsey.com/industries/life-sciences/our-insights/no-place-like-home-stepping-up-the-decentralization-of-clinical-trials. Accessed on 8th December 2021.

- Inan, O.T., Tenaerts, P., Prindiville, S.A. et al. Digitizing clinical trials. npj Digit. Med. 3, 101.

- What is a Virtual Clinical Trial and how does it benefit the Clinical Trial industry? Cloudbyz. 16 May 2021. Available at https://www.cloudbyz.com/blog/patient-recruitment/virtual-clinical-trial/. Accessed on 8th December 2021.

- Ryan Jones. Beyond 2020: The Future of CROs. Florence Healthcare. 21 August 2020. Available at https://www.contractpharma.com/contents/view_experts-opinion/2020-08-21/beyond-2020-the-future-of-cros/. Accessed on 8th December 2021.

- Better data collection and convenience for remote monitoring of patients are the main benefits of using digital health technologies in clinical trials: Poll. Clinical Trials Arena. 21 June 2021. Available at https://www.clinicaltrialsarena.com/news/better-data-collection-main-benefit-of-digital-technologies-in-clinical-trials/. Accessed on 8th December 2021.

- Guidance for Industry Oversight of Clinical Investigations — A Risk-Based Approach to Monitoring. FDA. August 2003. Available at https://www.fda.gov/media/116754/download. Accessed on 8th December 2021.

- Significant increase in virtual trial deals since 2020 as a result of COVID-19. GlobalData Healthcare. 16 August 2021. Available at https://www.pharmaceutical-technology.com/comment/significant-increase-virtual-trial-2020-covid-19/. Accessed on 8th December 2021.

Recent Post

-

10 Jul 2023Unveiling the Power of RWE Clinical Trials: India's Advantages and Emerging Trends in Pharma Industry

-

14 Aug 2022Trends in store for the clinical and contract research organizations post-pandemic

-

15 Jul 2022Real World Data (RWD)/Real World Evidence (RWE) with possible solutions in India